As the Mad Fientist, I take it upon myself to analyze common financial advice to determine how it applies to those of us retiring very early in life.

Since our financial lives are drastically different from the normal work-until-65 employee, most mainstream thinking isn’t relevant so I’m left to investigate the data myself and form my own conclusions (for example, when I showed that a Traditional IRA is better than a Roth IRA for early retirees and that a Health Savings Account should actually be used as an additional retirement account).

Today, I’m going to tackle the Safe Withdrawal Rate (SWR) and it is my hope that this post becomes the definitive guide to the SWR for early retirees.

Most of the conclusions in this article are based on the great research that Michael Kitces, one of the internet’s most respected retirement planners, has done on this topic. I’ve cited the source material below so I highly encourage you to read through the articles that I link to because they are packed with additional information that will help you feel even more confident about the conclusions of this post.

What is the Safe Withdrawal Rate?

Before we dive into the really good stuff, a bit of background…

The Safe Withdrawal Rate is simply the rate that you can withdraw from your portfolio every year that ensures you have a high probability of never running out of money.

The SWR of 4% per year (inflation-adjusted) is the rate that Trinity Study researchers recommended for 30-year retirements and is the rate you most often see quoted.

Why it’s Safe (Very Safe)

Many people like to challenge the Safe Withdrawal Rate and warn that “this time is different and if you start withdrawing 4% from your portfolio every year, you’ll be forced to eat cat food before you know it.”

Fear sells much better than math and reason so ignore the fear-mongering and instead continue reading.

Disclaimer: It must be said that although this article will show that the SWR is safe, past performance cannot guarantee future outcomes. If you’re looking for certainty, you won’t find it here. Nothing in life is certain though except for death and…well that’s it. Some people say there’s also certainty in “taxes” but since you’re a Mad Fientist reader, that’s not the case ;)

Kitces highlights some impressive stats to show how safe the SWR actually is:

- “the safe withdrawal rate actually has a 96% probability of leaving more than 100% of the original starting principal!”4

- “In fact, even when starting with a 4% initial withdrawal rate, less than 10% of the time does the retiree ever finish with less than the starting principal. And it has only happened four times in the ‘modern era’ of markets: for retirees who started a 30-year retirement time horizon in 1929, 1937, 1965, and 1966.”1

- “Over 2/3rds of the time the retiree finishes the 30-year time horizon still having more-than-double their starting principal. The median wealth at the end – on top of the 4% rule with inflation-adjusted spending – is almost 2.8X starting principal. In other words, it’s overwhelmingly more likely that retirees will have opportunities to ratchet their spending higher than a 4% rule, than ever need to spend that conservatively in the first place!”1

But This Time is Different

That’s great the safe withdrawal rate worked so well in the past but surely now with the great recession, recent flash crashes, etc., this time is different?

It’s not.

I know it seems like the financial world has been crazy over the last decade but recent retirees aren’t actually looking too bad.

In his post, How Has the 4% Rule Held Up Since the Tech Bubble and the 2008 Financial Crisis?, Kitces explains that “the 2008 retiree – even having started with the global financial crisis out of the gate – is already doing far better than any [of the worst] historical scenarios! In other words, while the tech crash and especially the global financial crisis were scary, they still haven’t been the kind of scenarios that spell outright doom for the 4% rule.”1

So what would the future have to look like for the 4% rule to fail for recent retirees?

It would only be appropriate to assume a safe withdrawal rate lower than the historical 4% – 4.5% rate if you believe that equities will fail to deliver even a 1% real return over the next 15 years, implying (given current dividend and inflation levels) that the S&P 500 price level will be lower in 2027 than it was in 2007 (which would also be lower than it was in 2000, resulting in no appreciation for 27 years!).4

Do you think the stock market will remain flat for 27 years? Are companies no longer innovating enough to eke out some growth in nearly three decades? Unlikely.

So why aren’t these scary crashes and recessions spelling the end of the Safe Withdrawal Rate?

To answer that, we have to investigate how a portfolio actually gets depleted too quickly.

Sequence of Return Risk

When you consider that the average real market return is 7%, you would think that withdrawing 4% every year would never deplete a portfolio because the growth would more than cover your inflation-adjusted spending (7% – 4% = 3% portfolio growth every year).

It’s actually not the average that matters though. Rather, it’s when the ups and downs happen that determine how likely your portfolio will survive longer.

Kitces gives the following easy-to-understand example:

imagine a retiree with $1,000,000 who needs to take a big $500,000 withdrawal at the end of the first year. With the “good” sequence, the portfolio grows 100% from $1,000,000 to $2,000,000, easily funds the $500,000 withdrawal, and after the 50% drop in year two finishes with $750,000. By contrast, with the “bad” sequence, the portfolio falls 50% to $500,000, the $500,000 withdrawal completely depletes the portfolio down to $0, and the subsequent 100% return is now irrelevant because you can’t compound an account balance of zero!3

As you can see, it’s the sequence of returns that matter. As he states, “once cash outflows are occurring, it’s not enough for returns to average out in the long run, if the portfolio could be completely depleted before the good returns finally show up.”3

So you need to survive the first part of retirement so that the inevitable gains that occur are meaningful enough to your portfolio to offset the down years.

First Decade Matters Most

In Kitces’ research, he analyzed the historical data to see what metrics actually matter when it comes to the SWR and portfolio longevity. Here’s what he found…

1-Year Return

Overall, the correlation between the safe withdrawal rate and the first year’s return is a mere 0.213

A correlation of 0.21 is low so if the markets crash right after you retire, don’t freak out. There’s very low correlation between your first year’s return and the success of the SWR.

10-Year Nominal Return

The correlation between the safe withdrawal rate and the 10-year return is 0.443

The 10-year return’s correlation is also low but that’s because the nominal return doesn’t factor in inflation.

If the market returns 7% but everything you buy gets 10% more expensive, it’s easy to see how the nominal return on its own can’t be a good predictor of portfolio longevity.

30-Year Real Return

on a 30-year real return basis, there is a solid 0.43 correlation to the safe withdrawal rate, which actually means 30-year real returns are just as predictive as 10-year nominal!3

This one really surprised me. You’d think that after factoring in inflation and looking at the 30-year returns, you’d be able to easily predict if a withdrawal rate would have been successful but it’s not because the 30-year returns don’t have enough information about the sequence of returns.

10-Year Real Return

When the time horizon is consolidated to view just the first 10 years and is evaluated on a real return basis, the correlation spikes to a whopping 0.79, with a clear predictive trend.3

Bingo!

As Kitces describes, “it turns out 10 years really is the ‘sweet spot’ for sequence of returns risk; a bad decade at the start of retirement is more predictive than 1-year returns and is also more predictive than 30-year returns”3

Therefore, if your first decade of retirement goes smoothly, you’ll likely end up with a lot of money leftover when you die (or you can increase your spending during retirement). If your first decade isn’t great and you deplete a big chunk of your portfolio early on, you may be in trouble.

Predictable

Since the real returns during the first decade of retirement are a good indicator of how likely a retiree’s portfolio will last, wouldn’t it be great if you could predict the next 10 years of real returns?

As Kitces describes, to some extent, you can!

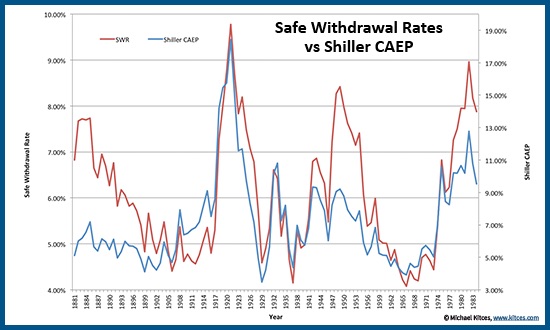

measures like Shiller P/E10 actually do a good job predicting real returns over a decade or more, which is the exact time horizon that matters for sequence of returns risk. In fact…if we look at the earnings yield of stocks using Shiller methodology (E10/P, or CAEP) and compare it to the 30-year SWR, the correlation is a remarkable 0.77! Market valuation and earnings yields at the start of retirement are remarkably predictive of 30-year safe withdrawal rates!3

Here’s a graph Kitces created that shows the historical Shiller E/P 10 (inverse of P/E 10) and the maximum sustainable withdrawal rates for the same period.

As you can see, there is actually a strong correlation between the two so you can use the Shiller P/E 10 (a.k.a. Shiller CAPE) to predict safe withdrawal rates!

Safe Withdrawal Rate for Early Retirees

If you’re like me, everything up until this point should make you feel warm and fuzzy inside. Not only is the 4% rule safe, it’s actually very safe and exactly how safe it is is somewhat predictable at the time of retirement.

You may be saying to yourself though, “MF, I’m not a normal retiree so these conclusions don’t affect me because I’m retiring so early in life! You promised to analyze the SWR for early retirees so give me the bad news.”

Thankfully, the news is not bad at all!

Longer Time Horizon

If you are retiring in your 30s or 40s, you’ll hopefully have 50 or 60+ years of life left so that’s a very long time for your portfolio to last. While withdrawal duration does factor into the equation, it’s not as big of a deal as you may think.

Quite a few researchers have looked into how longer time horizons affect the SWR and Kitces describes some of their conclusions: “increasing a time horizon from 30 years out to 45 years reduced the safe withdrawal rate from 4.1% down to 3.5%”2. He goes on to say that, “it appears that the safe withdrawal rate does not decline further as the time horizon extends beyond 40-45 years (given the limited research available); the 3.5% effectively forms a safe withdrawal rate floor, at least given the (US) data we have available”2

So why doesn’t even longer time horizons result in lower SWRs?

Kitces explains (hint: it goes back to the sequence of return risk discussed earlier):

over long time horizons, even balanced portfolios generate returns significantly higher than 3.5%, and consequently the primary constraint of safe withdrawal rates is just having a withdrawal rate low enough to survive an early 1-2 decade stretch of poor returns. If the withdrawal rate is low enough to survive the first two decades of bad returns, then eventually the good returns arrive, the client recovers and gets ahead, and adding more years to the time horizon is no longer a risk.2

So 3.5% is the floor, no matter how long you expect your retirement to be.

Is that the number all early retirees should use in their planning then? Not necessarily. I think there’s a lot of other factors going for us that still makes 4% a reasonable figure to use.

Early Retirees Can Still Work

Unlike most normal retirees, early retirees are much more capable of picking up work after retirement.

If you’re 70 and you just retired, going back to work is a very daunting prospect. Your skills probably aren’t as in-demand as they once were and your energy level has likely diminished as well.

What about if you’re 35 instead? You’re still young and active, your skills are probably still up to par with your working peers, and you have a great interview story about how you spent the last x years doing whatever cool stuff you did during your early retirement preview!

Now, I’m not saying you need to plan on going back to work but it is an option and that option can influence your asset allocation and long-term returns, which would affect your SWR success rate.

More Aggressive Allocation

Bonds are great in a portfolio because when stocks go down, your bonds hopefully don’t go down as much so when you rebalance, you can use the proceeds from your bond sales to buy cheaper stocks.

Stocks are the driving force behind your portfolio though so if you want your portfolio to last a long time, you need to have a good amount of stocks to fuel that growth. The more bonds, the less volatility but the less growth as well.

Therefore, it makes sense to increase your stock exposure if you’re hoping to increase the probability your portfolio will survive a longer time horizon. As Kitces states, “Bengen and Blanchett’s research suggests the optimal equity exposure for a 30-year time horizon is approximately 50%-60%, a time horizon stretched to 40+ years merits a slightly more aggressive 60%-65% equity exposure”2

What if you’re young, employable, and still willing to work (if necessary). Why not juice your portfolio by being predominately in stocks? You put yourself at risk of experiencing bigger upfront decreases but if you have other options that allow you to avoid selling shares when prices are depressed and you have ways to make money so that you can buy stocks when they’re cheap, maybe it’s worth the risk?

That’s actually my strategy. Since I’m not opposed to going back to work (and can actually think of many part-time jobs I’d actually enjoy doing), a high percentage of my money is in stocks. If the markets tank and my portfolio drops a lot in the first decade after leaving my full-time job, I’ll just pick up some part-time work doing something that I enjoy. After all, what better way to appreciate your freedom than to go back to work for a bit to remember what you’re (not) missing.

Flexible

Another difference between early retirees and normal retirees is that they are younger and likely more flexible and adventurous (no offense to my older readers).

If the United States experiences a period of high inflation, my grandparents wouldn’t consider moving to another country for a few years to escape the higher costs but you better believe my wife and I would!

Our flexibility would allow us to drastically lower our spending in tough times whereas that may not be an option for most standard retirees.

Etc.

There are many other reasons early retirees can be more aggressive with their withdrawal rate (e.g. hardworking people who achieve FI will likely earn money in many unexpected ways after retiring, inflation doesn’t affect low spenders as much, most early retirees don’t even factor Social Security into their retirement calculations, etc.) but the main thing is, if you were resourceful and intelligent enough to amass enough money to retire very early in life, I have no doubt you’ll be able to figure out how to navigate the rough investment waters you’ll inevitably encounter at some point during your early retirement.

Conclusions

There is a lot of information in this post so to summarize:

- The 4% rule is actually very safe for a 30-year retirement

- A withdrawal rate of 3.5% can be considered the floor, no matter how long the retirement time horizon

- The sequence of real returns matters more than average returns or nominal returns

- The real returns during the first decade of retirement are most predictive of withdrawal-rate success

- After retirement, remain flexible, embrace challenges, don’t stress out about things you can’t control, adjust spending when necessary, and enjoy life :)

Thank you again to Michael Kitces for doing all the analysis and number-crunching that I referenced throughout the article. Here are the links to his articles so that you can check out the excellent research he’s done:

1 How Has the 4% Rule Held Up Since the Tech Bubble and the 2008 Financial Crisis?

2 Adjusting Safe Withdrawal Rates to the Retiree’s Time Horizon

3 Understanding Sequence of Return Risk – Safe Withdrawal Rates, Bear Market Crashes, And Bad Decades

4 What Returns Are Safe Withdrawal Rates REALLY Based Upon?

5 Resolving the Paradox – Is the Safe Withdrawal Rate Sometimes Too Safe?

What Do You Think?

I’d love to hear your thoughts in the comments below. Is there anything I missed? What withdrawal rate are you planning to use when you eventually quit your job?

I did some very detailed research a la Kitces using the FIREcalc tool many years ago. I came to the same conclusion – the first 10 years is the critical part. If you still had 50-60% of what you started with, then historically your portfolio would recover and you would be completely fine for the rest of your retirement. Looking 5 years out didn’t help any, as there’s too much short term fluctuations to indicate any long term trend.

So maybe it’s a good gut check to see where you are 10 years out and how that compares to where you started. Have less than half of what you started with (in real terms)? Enter Plan B – cut spending or work more.

In reality, the research jives with what all of us early retirees would do anyway. If my portfolio was down by half over the first 10 year period, I’d be looking to cut spending and/or pick up some side hustle income to supplement portfolio withdrawals. It wouldn’t even take detailed analysis to make me do that!

Another great one, MadFIentist. Take care!

I love how simple you’ve put it. More than half, you’re probably okay. Less than half, then you may need to look at your options. Luckily, those who are dedicated enough to retire early probably also have the requisite skills to pick up odd jobs or reduce spending when the need arises, making this process just a bit easier. :)

It really was as simple as that. Looking at all the 100+ scenarios of 30 year periods that FIREcalc spits out, the great majority end in success. Those that fail do it early, typically at 10 or 15 years. And they all have about half of the initial portfolio value. Simple rule of thumb and a good gut check. Though I’d be nervous enough to cut expenses or try to make at least a few thousand $ per year before reaching 10 years and 50% of initial portfolio value, so my portfolio balance would tend to self correct.

I was thinking that rather than wait 10 years and then see where one’s at (10 years is a long time and that gap could make not so employable anymore), it might be better to taper off into retirement by working less and less each year. It doesn’t have to go from 40 hours a week to 0 hours overnight.

Agreed, Stunta. And I think that’s what a lot of people do. For myself, I don’t ever see myself working 0 hours because there’s a lot of fun opportunities out there that just happen to make money too. There are a lot of ways I enjoy making money remotely (software and web development work) that I expect I’ll always be involved in at least 5-10 hours per week. Of course, who knows what the future holds? Maybe the robots will be doing it all for us. :)

Sorry, for the beginner question: how do you calculate the value after 10 years in “in real terms”?

The actual value divided by 1 plus inflation (in decimal form) for the first 10 years. If you end up with $1,200,000 after 10 years and inflation totaled 20% for the first 10 years, real value = 1200000 / 1.20 = $1,000,000

What about the withdrawal rate that never touches principal? That’s what I’m shooting for in order to build up a big enough fund and ensure there will be money left over.

Depends on how you define ‘principal’. If I retire with $1M in my account, is my principal $1M? If that’s how you mean it, then your withdrawal rate that is guaranteed to never touch principal is 0%. The market could go down on day 1, so if I take anything out, I’m at risk of touching principal under that definition.

If you mean ‘never selling shares’, the Mad Fientist addressed that in the article:

“The robustness of the 4% rule is one of the main reasons I find dividend-chasing weirdos who don’t want to ever sell any shares so perplexing – not only will they have to work a lot longer to build up a portfolio that can sustain their spending on dividends alone, they are giving up higher overall returns to obtain a level of security that is simply unnecessary.”

Basically, using terms like ‘principal’ and ‘interest’ in this context indicate a naive understanding of investing. Basically attempting to understand every investment as if it were a loan. Total Return is a superior way to look at stocks and mutual funds – indeed most investments.

I am pretty naive, I gotta admit.

Do you think the S&P500 will go to zero though? If not, without leverage, can you help explain here or on one of my investing articles how can run out?

I’ve only got 30% of my net worth in public equities btw.

Thanks

I would use the dividend yield as a safe withdrawal rate that never touches principal. Something like 2% if you’re looking at an SP500 portfolio. It’s not too hard to get that % up to 2.5% by buying a large cap value index fund (IUSV comes to mind) or any of the variety of low cost dividend ETF plays (Vanguard has a good one).

In your other comment, you mention the remote probability of the SP500 hitting zero. Right on man! Dividends might take a hit year to year but they don’t even fluctuate as much as the SP500 value.

Couple a 2-2.5% withdrawal rate with the flexibility to chill out on spending during reductions in dividend payouts and you’re set. I don’t see a reason to lower the withdrawal rate below 2% unless you simply can’t find a way to spend the money or you want to grow your assets for future generations or for philanthropic purposes.

Of course, we must always remember that gov’t requires us to do the MRD.

Then we can reinvest what’s left after taxes.

It doesn’t make sense to me to wait 10 years to reevaluate our safe withdrawal rate. It seems to me that the more frequently you recalculate your withdrawal amount, the better your chance of success will be. Let’s say that today we calculate our safe withdrawal amount to be $30,000 and tomorrow the market crashes 50%. The best thing to do imo would be to immediately recalculate the amount you can withdraw using your new portfolio value, not to say “well, my initial calculation said I should be fine” or to use a simple heuristic like “if portfolio is less than half it’s value, go back to work”. Obviously there are practical impediments to constantly recalculating and altering our spending, but the more you can do it the better.

Agreed! I would look at it as “take out 4% each year,,,if your portfolio goes down, the 4% is a lower dollar figure”.

“Nothing in life is certain though except for death and…well that’s it.”

HILARIOUS!!!!

“If the markets tank and my portfolio drops a lot in the first decade after leaving my full-time job, I’ll just pick up some part-time work doing something that I enjoy.”

I’ve had this same thought with a minor tweak. For me, frugality is the key. For example, if you need $100,000/year to get by ($2,500,000 in initial savings) and the market takes a huge dump in the first 10 years, it’s going to be difficult to move the needle by going back to work. However, if you can get by on $40,000/year ($1,000,000 in initial savings), you could do something painless like Uber for 4 hours/week or rent out a room with Airbnb to get your plan back on course.

Kitces is just great. I hope to see him on a Mad Fientist podcast in the very near future!

Especially after seeing MMM live on 25k a year, knowing that others can do it really makes me feel a lot better about the whole thing. We’re currently at 40k expenses ignoring daycare, but that’s what, 60k salary with no savings? And we’re not trying that hard…

I know, right? We’re at 40K too and we live a luxurious life. We have a nice home and go on great vacations. If you’re willing to live in a modest home and not buy new cars, you’ve already won most of the battle.

Yep, it’s not the “latte factor” keeping people from retiring.

Housing & transportation are the largest discretionary expenses here in the U.S.

Yet most working couples will finance a home with the largest mortgage for which they can get approved.

If even one of them is forced to part-time employment, often there goes the house.

I learned this lesson early, growing up in a 6,000 sqft home (for this area, a mansion back then).

But when my parents got divorced mom blew through her six figure cash settlement in only a few years, mostly feeding her hobby of renovating & redecorating the house (and no, those changes didn’t add to its value when she was finally forced to sell).

My town-home of 15 years is about 1/3 the size, paid off years ago, all exterior maintenance plus landscaping taken care of for a modest monthly fee.

If we move it will only be to something smaller & even cheaper to maintain.

I’ve had the argument over “how easy is it to make some cash during a bad market downturn” so many times (most recently on Reddit /r/Financialindependence). It’s so hard to persuade people that yes, it’s possible to find a job, any job, during a downturn, or do odd jobs (Uber, mowing grass, babysitting, etc). You don’t have to make as much as you used to, just enough to supplement your portfolio withdrawals during bad times. 10 hours per week at $10 per hour equals $5,000 per year. And I think it would be hard to find a job for less than $10 than hour (walmart pays that in most places!). $5,000 per year of earned income replaces 1/8 of the $40,000 you pull from a million dollar portfolio. Realistically, I think $15-20 per hour is a better number to use for the smart folks that typically reach FI and retire early.

But the internet warriors won’t concede the point! It makes me sad. Not really. I just keep enjoying early retirement! :)

Exactly! Assuming 40K is your yearly spending, even a very, very easy $5,000 per year brings the 4% down to 3.5% which is huge if you’re early in the game.

Also, we’re a sharp bunch and most of us will make money no matter how hard we try not to! All of our blogs bring in some cash. Are we in it for the money? Nope. But just like that dollar I find on the sidewalk, I’m not turning it down either.

I think a big issue for some people is ‘golden handcuff syndrome’ where they have a skill, are in the prime of life, and are afraid of that skill degrading over time to the point it is unusable (Medicine, law maybe engineering). Could a physician go back into medicine 15 years after retirement? It may be scary to give up a $200/hr salary to think you may have to go back to work in the future for $20/hr so high earners I think are more reluctant to retire. The seduction of just ‘one more year’ and I’ll be that much safer…

Ironically I think it may be easier for someone who is lower on the hourly wage scale to retire because if they have to go back into the work force it wont be such a reduction in what they are used to making.

Well said! Certainly describes my situation.

I’m an engineer, and that describes my situation. My solution is to plan on taking consulting/contracting jobs for a few months a year. They are easy to find and pay well. Your skills are kept up to date and after a few years , you can either go back full time or quit completely

We can also try and flip this around – if you know you’re FI but suffered from the “one more year” syndrome for a few extra years, you can count those years towards the first 10 years of early retirement and reduce your sequence of return risk (or start from the actual RE date with lower SWR).

Love it! My wife and I are planning a 3.5% SWR during the first several years of retirement, but like you alluded to, even that might be overly conservative. But I’m also looking to retire when I’m 35 (next year), so being conservative here I believe to be a wise decision at this point. :)

Nice article, well researched. Now, off to read more of Kitces’ stuff. :)

MadFientist,

I realize this is another post entirely, but how would this information factor into a “typical” retiree’s decisions on when to take pensions or SS?

For example, many near-retirees (a lot of us Early Retiree’s Baby Boomer Parents) are coming to retirement with taxable accounts AND pensions and SS.

If the main threat is Withdraw + Real Performance over the first 10 years. Would it be a smart strategy to take Pensions / SS immediately at retirement and leave Taxable/401/IRA at 0 to 2% withdraw over those first 10 years?

(As opposed to waiting for Pensions or SS to reach their maximum value at later age)

Would love to see a whole post from you on this topic. I think it’s one a lot of us (and our parents) wrestle with and needs some of your great MadFI Math-love.

Hey Lucas-

I was just poking around the net about this same topic. I’m not an expert, and I don’t grasp all the math behind net present value calculations (to say nothing of the assumptions that have to be made), but basically, the recommendation was that if you have a good chance of living to 80, it’s worth delaying the benefits, since the “rate of return” you get from delaying is a very solid one, and the difference balances out about 10 years down the line from the latest date of starting to get SS. Statistically, women live longer than men, so women have an added incentive to delay. If you have a medical condition that leads you to believe that you might not make it to 80, then yes by all means start taking it.

Hey Sam,

Thanks for sharing – Would you mind sharing a few of the links to the stuff you were reading on this topic. I hear what you are saying, but I’d like to dive into the details and I haven’t had much success finding reputable (math based) info myself.

Also a question: I understand it’s a fairly simple equation on the Age-vs-Rate-of-Return gained by years waited if SS were the only consideration. BUT, if you consider the total difference in take SS at say 60 vs 67 compared to taking it a 60 + Mitigating X% of risk to your primary portfolio (the dangerous first 10 years from the post) is it still worth it? Obviously this would be heavily dependent on the size of your Nest Egg vs your expect SS benefits. Tough one.

My 2 cents reading on this topic. If the markets are good, use the funds from the market instead of SS. If markets are bad, then use SS for living expenses

A couple more cents, if by taking ss your withdrawal rate goes down to 3%, that would indicate your portfolio is sufficient. If not,mthen you might want to postpone and wait.

Take Social Security as soon as you can! If you die, you can’t collect. But, if you can leave money in your investments, your heirs will get all that money should you expire early. My math tells me that the only way taking social security at age 62 doesn’t pay off is if you live past the age of 82. If I live that long, I’m sure I won’t be complaining about that extra $1,000 a month. Plus, my investments that I didn’t spend early, will be there for me.

Don’t forget to think through the trailing spouse scenario! Yes, women live longer than men. But if the man had higher income and higher SS benefits, the decision to delay not only affects his SS but also hers as a widower if he were to die first. (Same goes if she was the higher earner and predeceases him, of course).

Most articles focus on determining the probability of success of taking the SWR every year, without adjustment.

How could we invert this analysis and try to determine the correct SWR *for the current period*. In other words, in lean years we should take 2.5% (for example) but in good years we can afford to take 6%.

How could we think about that?

Dave

I would suggest looking at the work on investment cycles by Crestmont Research. The book Probable Outcomes is very good.

There are multiple variable rate withdrawal strategies. cFIREsim implements several of them

Wade Pfau’s paper on the topic: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2579123

So if we assume that the the PE ratio is a good indicator of future stock market returns, would that not suggest that a low PE ( ie a down market) means the WR can be increased as opposed to decreased – for example a PE of 25 support 4% so a PE of 15 might be 5%, so you would be increasing WR ( at least as a % ) in down markets, seem like an easy calc to use for a variable withdrawal strategy and help flatten spending in volatile markets?

Is it possible for anyone to run a simulation on the success rate of a variable withdrawal strategy using PE25 and 4%WR and adjusting by .1% in either direction each year. So a PE of 21 would support 4.4% while PE27 would only support 3.8%.

This is awesome. The biggest takeaway for me was that I’d been using my average spend including daycare which wouldn’t be needed if I was retired! That let me lower my expenses by 2k per month (yipes). My wife just got a raise so it does make sense to have daycare for the two kiddos (it was just more than the baby daycare cost) but if we have a 3rd we’ll re-evaluate.

This tool is awesome and I love the SWF indicator!

Also, I guess all of this made me remember how much we’re throwing into investment accounts every month. We’re saving over 50% and we still have leftover money that we throw into our house principal.

Just want to alert you, as a person who has older kids, that that day care expense will seem pretty small in future years. Your kids will likely not be able to be off your medical plan until they are 26. You will likely support their auto insurance costs, their cell phones, and possibly their rent, and fees for college and so forth, until then, and even later, too. Don’t assume your kid expense ends when they are 12 or soemthing and no no longer need child care. Assume the same and more through mid 20’s. Just injecting some reality here, without assuming you will be raising your kid’s kids, if yours flame out as so many do. One of mine needed extraordinary after-tax investment for care from trauma. No safety net for that. Assume the worst and hope for the best.

Sorry for replying to a 7 year old post, but as a family with 1 daughter in her freshman year at UC Berkeley and twin boys in the 12th grade, I consider child expenses in our top 3 line items. I assume many people here are in a financial position to retire early because they made a good salary, which often means they live in an area that attracts intelligent people and has plenty of high paying jobs (we live in the San Francisco Bay Area) and probably live in the million dollar home they purchased for only $100k decades earlier (if only we knew, I’d have bought two!).

Most of us want our young adult children to live near to us so that we can be near our future grandbabies. Sadly, young adult families can’t afford a million dollar home without financial assistance from mom & pop. Mom & pop may not want to uproot decades of life and friends to follow their young adult children to Texas or North Carolina or wherever they land a job and buy a home for $300k. We put into our budget moderate financial assistance for our 3 kids in the event they start their career strong and also live in an area with plenty of high paying jobs, which is the same as high cost of living, in order to purchase their million dollar fixer home. They will certainly rent out rooms to help pay their mortgage, just as we did when we bought our home.

Excellent summary of the conclusions in the latest research. Thanks for this excellent post.

What does the research on this topic say about how we should adjust the 4% for inflation year after year? Is it CPI?

Marc

The Financial Mentor Podcast interviewed Wade Pfau who sounds like he’s also done some very interesting research in the same subject.

By listening, I was convinced to up my bonds allocation to 30%, since as an aspiring retiree moving toward my “number”, I feel it does make more sense to have a more conservative portfolio than the 20% or lower that you and others advocate.

Here are the links:

http://financialmentor.com/podcast/001-retirement-income-wade-pfau/10243

http://financialmentor.com/podcast/automatic-income/10653

Another great one. My wife and I plan on “retiring” really early and “working” part time for the first ~10 years or as long as we need/want to. We live in an RV now in FL and live (luxuriously, and easily) off of <20K per year. Our plan in early retirement is to work seasonally enough to make ~30K (think rafting/ski resort/hiking guide/travel consultant) or anything that can be found on coolworks.com and still continue to max out our IRAs while not touching our portfolio.

We also plan to live part of the year in Guatemala, Mexico, or Ecuador, etc… where we can practice our spanish.

We're 100% invested in stocks and don't mind being a little risky ;). These types of post pump me up even more and get me excited for the many possibilities with FI.

Keep up your good work. (your blog is my favorite, though don't tell GCC or Mr. 1500!)

Coolworks! Thx for the tip!

Joe,

That is what my wife are looking to do in 5 years. The Coolworks link is awesome! Thanks for that!

Here’s what I don’t understand: if the first decade of real returns is so important and so predictive of the success or failure of the portfolio, wouldn’t it make sense to have a less aggressive investment strategy during the first 10 years… and then once you escape the first 10 years, then to make your portfolio more aggressive? Lots of smart folks here, so I must be missing something. Please help! :)

Wade Pfau advocates this approach. Check rising glide path

Thanks, John. According to this link, it looks like Michael Kitces himself supports a rising glide path for equities, as a way to reduce sequence of returns risk, so I’m eager to get MF’s take on this. This references a paper co-written by Pfau and Kitces.

http://tinyurl.com/pkwz5fm

Super interesting paper. +1 to MF chiming in on it. I found it super interesting that High starting

Static levels of equity exposure often resulted in similar levels of success but always seemed to result in a much larger medium legacy. Now is that “failure” risk worth it? Now that’s another question :-)

+2 to MF Chiming in on it. This sounds like a good idea, but I’m interested to hear what he thinks.

I realize that this is an old comment, but for anyone interested in this question, Kitces has written that the danger in the first decade is not so much that there will be a big crash, but that there won’t be decent market gains. So if I retire today and take a super conservative investing approach in the first decade, I’m increasing my risk of failure, because I would likely have mediocre returns in the first decade, right when I most need the good returns that the market gives on average.

https://www.kitces.com/blog/why-merely-mediocre-returns-can-be-worse-than-a-market-crash/

My understanding is SWR calculations don’t factor in taxes and fees – is this true? Granted, both can be minimized using strategies from this site, but they’ll be non-zero for most of us.

Also, these studies are US-based, so people in other countries might want to be more cautious (most markets have underperformed the US, at least historically, and most other developed countries have higher taxes and investment fees). The limited research I’ve seen for the UK indicates higher failure rates for a 4% SWR, for example.

Thanks for the article, which gives a nice take-home summary of the research.

Sequence of Returns is to distributions what Dollar Cost Averaging is to contributions. Is this pretty much the gist of it?

It is the same idea, but instead of getting the benefit of buying more shares when prices go down and less shares when prices go up, you get the penalty of selling more shares when prices go down and less when prices are high. DCA on the way in helps you, but this hurts you in the same but opposite way.

Great article and data. We have a balance portfolio with the right risk. We plan to use the 4% as the SWR amd agree that frugality goes a long way. Heathcare costs remains a curve ball in our plan. We plan to get by with 70K a year.

Keep up the good work and data flowing.

Jeremy, this post was a tour de force of optimization analysis.

And if the analytical rigor weren’t enough to convince readers to take it seriously, the newfound use of end-of-paragraph punctuation would be ;)

I second Justin’s comment that no better evidence for the need for tax reform exists than the stunning complexity of the analysis that went into this post.

Thanks brooklynguy! ;)

Woah, how did this comment from Gocurrycracker end up on MadFIentist’s page? ;)

Anyone ever seen GCC and MF in the same room at the same time? What if they’re the same guy?

I will have that honor next week.

But if they are the same, no one will hear it from me. :)

Who knows how deep the conspiracy runs? Maybe all of you FIRE bloggers (including you two, Justin and Jim) are the same person, which would explain all the incestuous cross-commenting across the FIRE blogosphere.

Soylent Green is people!

(For the actual explanation of how this comment wound up here, see my other comment below.)

I figured I would buy each of you bloggers a beer if we ever crossed paths for all the great advice. I am excited to find out I will only have to buy a single beer since there is only one of you. My expenses for the year we meet will now fit within the 4% SWR.

Well, I keep hearing great things about Justin’s blog, so I’d be cool with folks thinking that…

Oh yeah, it’s October already! You guys have fun down south!

Excellent summary of the SWR landscape, MF! Re: the relationship between CAPE and SWRs, I would just note that in the periods subsequent to 1985 (for which we don’t yet have fully-elapsed 30-year periods but for which we do have some periods long enough to suggest that their lofty starting-year CAPE was less detrimental to SWR than prior history would have predicted, unless the future brings some truly catastrophic market performance over the remaining unelapsed portions of those 30-year periods). In other words, even the already-optimistic results of your SWR indictor gauge may be overly pessimistic!

And please excuse (and feel free to delete) my comment above, which was intended for GCC (reflecting the hazards of multitasking while reading and commenting on multiple early retirement blogs at the same time!).

Great article but to make it more practical I assume you are leaning towards the “bucket” approach v/s the “floor” approach, right?

Hello,

I noticed that Wade Pfau is already mentioned so I won’t post it again but please go to https://www.bogleheads.org/wiki/Wade_Pfau and scroll down and read his blog links. It will add more to your research.

Mad Fientist to the rescue! This makes me feel a lot better for my situation seeing I have the same strategy as you and will probably be in stocks for quite a while.

I know a lot of people keep going back and forth on the 4% rule, but seeing more posts like this putting numbers behind it is definitely a comfort! Being young and able to go back to work will help quite a bit along with being frugal and not increasing our spending. Thanks for the great info as always!

Does the 4% SWR take into account only the monies invested or is it based on net worth including the value of one’s primary residence.

For instance, if one’s net worth is 1M and 200K of it is home equity from the primary residence, is the SWR 4% of 1M or is it 4% of 800K?

Thanks

Typically, no – it does not include real estate. If I were making this calculation based on your hypothetical numbers, I’d take the $800,000 figure only with the understanding that I might be able to downsize homes or sell the property to provide additional income as necessary.

Thanks. That makes things a bit more interesting. With the same example, the equity of 200K effectively generates a guaranteed savings of x% where x is the interest on the mortgage. x varies from property to property, but if lets say we fix x at 4%; does that mean its still feasible to have a 4% SWR?

If one is renting, then the same math may not apply, but keep things simple, lets say the mortgage interest + property tax + ownership expenses are about the same as rent.

Someone far smarter than me might be able to provide a more concrete answer to your question, but…

Everything boils down to your total expenses for the year, whether those expenses come at the hands of gas for your car or interest for your home (at least that’s the way that I’ve read the Trinity study and its findings). Having a mortgage on a home will naturally take a bite out of your living expenses. A 4% safe withdrawal rate is feasible if expenses are low enough, mortgage or no mortgage. No mortgage definitely makes it easier.

Low expenses of course makes life less costly, but it may not be the life you desire to live. But be careful to understand cost of investing–expense ratios and turnover costs.

I plan on living off dividends and eventually a pension. My dividends have been increasing faster than the rate of inflation which means I won’t have to touch my principal and the SWR need not apply.

I feel sorry for people that need to work at thankless jobs for 5+ years longer than the rest of us ER’s because they are holding out for a retirement funded by dividends only. It’s probably fun to say you are living only on dividends at dinner parties, but the cost is WAY too high.

I feel antipathy toward “financial gurus” and bloggers that espouse this strategy because they always fail to share the alternative and they are preying on people’s confirmation bias and their overly-conservative instincts.

As MF said: “The robustness of the 4% rule is one of the main reasons I find dividend-chasing weirdos who don’t want to ever sell any shares so perplexing – not only will they have to work a lot longer to build up a portfolio that can sustain their spending on dividends alone, they are giving up higher overall returns to obtain a level of security that is simply unnecessary.”

Please don’t feel sorry for people (or at least all people) who plan to live off of their dividends or partially live off of their dividends. I have enough in savings and investments to have retired already but I like my job and don’t want to retire yet. Increasing my dividends gives me a goal to aim for. I like goals. I am practicing being retired by working on skills and projects that will keep me active in retirement so I will enjoy it as much as I enjoy my work. Everyone’s situation is different. What doesn’t work for you may work for others.

What is the difference whether you sell stock to get your 4% SWR or spend them from dividends? Money is money. If I need $40k a year in retirement the 4% rule says I need $1,000,000. If I am harvesting dividends I need $1,000,000 with a 4% dividend average. If I have a 5% dividend average I only need $800,000, seems like that might be the best way to go cause I can hit $800k faster than $1M.

When I saw the headline, I was hoping you would go into why 4% is way to high a number for early retirees, as that is a pet peeve of mine on the ER sites. A couple comments.

1) My main point. To mention him again, Wade Pfau’s (who has an interesting blog and is the most prolific researchers on trinity study related items I have seen) research shows that 4% SWR for 30 year retirements was in some sense a historical/geographic accident. The numbers look much worse in other countries. See table 3.2 http://retirementresearcher.com/the-shocking-international-experience-of-the-4-rule/. His SWR term is SAFEMAX. He has a ton of research showing why 4% is insufficient for regular retirees.

2) His research also shows that there is reason to think in the US that this time it is different. If we are in a new low bond yield normal (even if it is only for 5 or 10 years from retirement date) the results look far worse than 4% for 30 year retirements: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2201323

3) When people say SWR, they mean without going back to work – ER blogst tend to assume going back to work to help make this work (your post references this as well). While it may mean it is less risky to quit (in terms of how ruinous it will be for your life) since you can more easily correct by working if needed, I would not call that SWR. That logic can be used to support any historically functional SWR by saying there is a chance it will work and if not I will go back to work (e.g., 6% has worked many years historically so since I can go back to work 6% is SWR). I would define SWR as X% chance can maintain constant inflation adjusted spending rate forever. SAFEMAX in Pfau’s research sets X as 100% for historical data. Ability to go back to work is a separate concept from SWR.

4) Some taxes can occur either do to income level or to residence (state taxes are pretty much unavoidable in certain states) which further reduces the numbers. In addition tax laws can get worse – it was only for the past ~20 years that LTCG and div lower brackets were zero. While this is a guessing game and state dependent – I do not think assuming 15% or higher taxes is a bad assumption.

5) going further than I need to you – but these numbers assume perfect indexing something that did not exist for most of the period and very few investors experience perfect indexing type returns. While this is mainly behavioral + expense ratios you could perhaps lock it in by using Betterment or something like that you would have .15% + expense ratios in fees (about .26 with fees last time I looked at their breakdown).

To summarize,

Need to:

1) adjust assumptions for historical accident + low yield environment – a lot of assumptions can be made here and this is where Pfau has done a ton of research – but in some plausible well thought out cases 4% looks more like 2%

2) adjust for >30 year

3) Reduce by absolute in investment costs. I would use .26 (though it might be the case that if you model the effect on SWR across the years, I think this number end up higher – I did not think too long on that so unsure)

4) Reduce by .15 of SWR taxes.

I think the expected SAFEMAX for ER starting in the next 10 years is far closer to 2% than to 4% even in the optimal stock bond mix for a stock bond portfolio.

Hey Dan, I see your post so it’s here in cyberspace for all to see.

Those are some good points. As for point number 2, low real bond yields going forward are sort of a non-issue for many early retirees that are planning for a stock heavy 4-6 decade early retirement (historically a stock heavy mix yields the highest survivability for long retirement periods).

Looking at FIREcalc (which uses the Trinity methodology and data), the “percent of scenarios that end in success” for a 75/25 stock/bond portfolio is 95% whereas the 100% stock portfolio is 93%. I didn’t read the full linked study in your bullet point # 2, so maybe they get further into the numbers in that study.

In other words, skip the bonds, reduce your chance of success by 2%. Still a pretty high chance of surviving long term even in today’s low yield environment.

In today’s low bond environment, I think it makes sense to go lighter on the bonds than would be suggested by historical returns. I’m near zero bonds other than a couple years worth of cash and a small individual bond holding of <1% of portfolio value as a 35 year old early retiree.

I should have given more detail. Low bond yields imply lower equity yield unless you experience higher equity risk premium. It is not bond yields in isolation. Basically if the same risk premiums are demanded by investors, but the risk free rate is lower for a lengthy period, all asset class expected returns should be adjusted down. Table 3 of that paper gives optimal allocations and their failure rates under one set of assumptions (numbers are frightening). I think (though I am not an expert on this like Pfau) that you can even make a case that risk premiums will shrink due to yield chasing equivalents which would make the results look even worse. Pfau gives a different reason that it may shrink in a footnote though he assume it is staying the same for the paper.

Wow, that is some scary stuff if true. A 95% safe withdrawal rate for a 40 year retirement is 1.6% according to the paper. This just boggles my mind.

I think part of the reason the paper doesn’t make sense is that they seemingly cherry-picked some very low real TIPS yields back in 2013 that are much higher today (positive 0.20% for 5 year TIPS versus negative ~1% back in 2013). In other words, it is once again pretty easy to construct a risk-free portfolio with a slightly positive real return using laddered TIPS.

If one really accepted the article’s premise that safe withdrawal rates were in the 1.6-2.0% range for 30-40 year retirements, then I’d just skip all this fancy investing stuff and just buy a 30 year TIPS ladder and get 0.2-1.0% real return.

Even at 0% real return, I could get a 2.5% withdrawal rate for a 40 year retirement with 100% success (by spending down the assets).

Another way to examine the 1.6% SWR from the paper is to look at the dividend yield on stocks today. It’s something like 2% (after fees!) from VTI or SPY. I can’t see spending less than 2% per year as an absolute floor.

One more note on the paper you link in bullet 2 – they switch up the methodology from the Trinity Study of looking at actual historical series of returns and instead the researchers use a Monte Carlo simulation. In other words, there’s no time series correlation of subsequent year returns. However we all know stock returns tend to be mean reverting and bad year(s) are normally followed by good year(s).

The basic idea is that we are in uncharted territory. It was not cherry picking but based on when the paper was written. in savings required. It is also deliberately not using trinity for predictions as it is modeling future possibilities with today’s uncharted numbers. There are weaknesses to monte carlo, but that is one of the better ways to do this,

Dividend yields can go down so SWR can theoretically be lower than dividend yields even ignoring expenses and taxes

Looking at this a different way, you could view stock return as a function of earning yield, earning growth and speculative return (increasing or decreasing P/E). Add in variance and/or sequence of return risk adjustment and that can result in some fairly low SWR with today’s suggested numbers.

I tried to add a post linking to his predictive spreadsheet (twice) but it did not go through either time and has now been over an hour on the first. Trying again:

http://www3.grips.ac.jp/~wpfau/Pfau_MarketValuations.xls from article:

http://retirementresearcher.com/can-we-predict-the-sustainable-withdrawal-rate-for-new-retirees-supplemental-materials/

If the authors of that study re-ran it with today’s TIPS yields and the resulting equity returns, we would get a lot higher SWR. Not sure if it would be 2.5% but definitely higher than 1.6-2%.

As far as my cherry picking comment, they looked at a snapshot in time and it has since changed. I wouldn’t worry too much about the numbers based on his study. If worried, just buy today’s TIPS and create your own 100% survivable 2.5%+ SWR portfolio for 40 years.

Completely agree would get higher numbers today though still not 4% (and again before fees taxes etc). Objected to cherry picking because that suggests they picked the time – it just happened to be the numbers when they wrote the paper. Spreadsheet, if I did my numbers right suggests somewhere in the mid 3s using today’s numbers (though that model may be older/different from what they used for the paper) They are making predictions based on the present using regressions created from past results picking reasonable variables. Error bars are fairly large on these predictions even though the fit is good. I am not too worried about <2% (though it is possible), but I would be quite comfortable taking even money bets that SWR will be under 4% in the +-10 years from today starting time for 30 year retirements.- and for ER the numbers cna be far longer.

I think the important point is that there is a solid chance that 4% will fail for ER if you start now and even 3% would not be particularly conservative once everything is factored in. Somewhat arbitrarily picking a whole number, but I would view 3% as kind of the highest acceptable SWR for spending.

Also, you might find interesting. He made a spreadsheet of his predictive model for SWR for different stock bond allocations which can be found here. Don’t know if he updated it since publication but it is what I could find. It backtests pretty well:

Article: http://retirementresearcher.com/can-we-predict-the-sustainable-withdrawal-rate-for-new-retirees-supplemental-materials/

Direct Spreadsheet link: http://www3.grips.ac.jp/~wpfau/Pfau_MarketValuations.xls

Okay, here is a question regarding the other side of sequencing of returns. Let’s say we retire with a portfolio of $1M. We take out $40k in the year 1988. Forgive the details on the math, but let’s assume 3% inflation all the way through, and ten years later, you have a portfolio of $3.4M and you’re only drawing $52k from it, or 1.5%. I understand that you can’t just readjust your withdrawal rate to 4% every year, especially since markets go down. But if you had retired with that portfolio in 1997, then you could have started at 3.5% and been perfectly safe. In that case, is it “okay” to adjust your withdrawal rate to $98k? While I don’t want to run out of money, I also don’t want to end up with a nest egg of $17M when I retire, either.

I sometimes think I want to wait until my nest egg is big enough for dividends alone to support me, but posts like this remind me how impractical that is and not worth the extra time to accumulate! Great analysis MF!

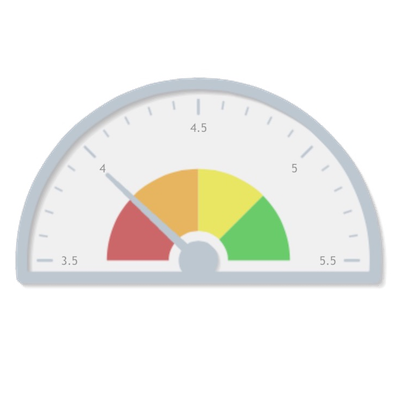

Very nice. I love that the SWR dial goes to 5.5%

I thought the Kitces CAEP vs SWR chart looked familiar, so I had to dig. I made a similar chart (but future CAGR_10yr_real vs SWR) when I was analyzing withdrawal rates in perpetuity. The fascinating thing is, if you retire when CAPE is low it is because you had crap market growth while you were accumulating. Most of your wealth is savings. If you retire when CAPE is high, it is (often) because you had amazing growth when accumulating. Most of your wealth is growth. You never get it both ways.

Because the 1st decade is such a powerful indicator, we made conscious plans to minimize spending during that time. That’s why we started traveling in Mexico/Central America/SE Asia instead of Japan/Australia/UK. It is pretty cool when post retirement and you are still LBYM and the portfolio continues to grow.

Although I generally reject market timing, I like the concept of using Schiller CAEP to get a vague sense of how risky the current year is for early retirement.

A while back I saw a post claiming there’s an even better predictor of equity returns over the next decade. I’d be interesting in your thoughts on it:

https://www.reddit.com/r/investing/comments/2ptjkk/the_single_greatest_predictor_of_future_stock/

I’m not good at that stuff, so I can’t calculate it myself. I’d love to see your indicator offer that as an option, if you are so inclined.

Great Post!

Plex

This is why we love MAD-FI

Like us he’s a numbers guy.

“Are companies no longer innovating enough to eek out some growth in nearly three decades? Unlikely.”

Eke, not eek. I can’t help myself. ;)

Are there any general rules about when you might consider upping your retirement rate (maybe back to the original basis). If you started with a SWR of 4% and your inflation adjustment has your current withdrawell rate at around 3.5% can you safely up it to 4%?

Another great post. The way I see it most studies are based on a traditional strict lifestyle and not the lifestyle of a traditional early retiree (ER). An early retiree is actually more likely to still succeed when a 4% SWR fails. Allow me to explain.

The current SWR studies are based on not ever working again and not adjusting your lifestyle once retirement starts. To become an ER typically one needs to become a frugal ninja master of savings, expenses, and lifestyle flexibility. These skills don’t all the sudden go away once retired. In slim years where 4% is failing most early retirees will simply pick up some part time work. In fact my guess is most ERs will be supplementing retirement income even in good years but we can overlook that for the sake of this argument. Along with taking part time work, in bad years ERs would be more likely to have an easier time cutting some expenses. Some may even spend part of the year abroad in cheaper countries.

The 4% SWR has a very high chance of success as most studies show. However add that in with the skill-set of an ER and I humbly suggest the adjusted odds are about as close to 100% success as anybody will ever get. I realize taking part time work might be seen as a failure in the true sense of the word “retirement”. However my guess is it still feels like a success compared to 40+ hrs a week in a cubicle plus 1.5 hrs of daily commute times.

The other way to look at is would you rather have the 4% SWR fail in traditional retirement at age 70+ or in early retirement at age 40+. In both cases it may fail and in both cases the person needs to find some other source of income. It just makes a heck of a lot more sense to me to follow the early retirement path and adjust as needed. Now if I only realized this 15 years ago.

Yes, that’s the key. And most articles, including this one, do point this out. The 4% SWR only fails if the person refuses to change their spending habits during less-than-optimal times during retirement. Most of us aren’t robots and are fully capable of adjusting with the times, thus making early retirement quite successful whether remaining at a 4% SWR or not.

ER is more risky for this very reason. ER folks are frugal and there is no more “fat” to cut from the budget.

Also going back to work after a gap is impossible in Silicon Valley (which are my core skills).

If you are willing to flip burgers remember that in recession there is more competition for those jobs than in good times

+1. I think it’s easy to underestimate the risk.

Economic downturns make it an employers’s market and they are going to favor candidates with current and relevant experience.

Plus, most of the ER blogosphere is comprised of folks that have recently retired and are relatively young. We don’t have enough data from folks who are now 70 plus and retired in their 30s.

I am not against ER. In fact I am planning for it. However, I am going to need a cushion and a plan B before I feel comfortable with it. I’ll also assume that I will not be employable again after ER. Adding variables increases risk.

My current POA is to reach FI and then gradually ramp down my working hours to ER. If the economy goes south during ramp down, I am expecting to have a better chance of being employed. The cushion provided by the ramp down period will hopefully mean another crash at a later time will not have a significant long term impact.

Please feel free to poke holes in this plan. Feedback would be useful.

Totally agreed with this point about risk. We’ve already trimmed all the fat, and for many of us, our “target” is already assuming a 4% SWR at a frugal lifestyle level.

Becoming frugal (or turning frugality up to the max) is what makes ER a possibility in the first place. Once you retire early, you already are frugal, and going beyond that point is likely to actually bring some pain.

I found this article very interesting. Noting that the first decade is the most important, I couldn’t help but wonder if implementing a Dollar Value Averaging strategy in the first decade could help eliminate some of the “unknown” risk of market returns over the period. I’d love to hear some other thoughts on the combining of the two strategies to maximize success or even see some number crunching.

http://earlyretirementextreme.com/day-21-investing-for-early-retirement.html

https://en.wikipedia.org/wiki/Value_averaging

Excellent post!! The most important takeaway for me was in your conclusion:

After retirement, remain flexible, embrace challenges, don’t stress out about things you can’t control, adjust spending when necessary, and enjoy life :)

I absolutely agree with that. I think if you’ve planned well and you’re not a champagne-lifestyle guy or gal, you’ll probably do just fine. Besides that, many early retirees are going to be retiring just from their main career and will likely be doing some other type of “work” that will bring in some kind of income, however small it might be, that will probably bring down the need to draw even the 3.5 or 4% number.

— Jim

Interesting stuff. So I’m wondering if the first decade is so important to the success of the following decades if we can improve our success by mitigating our market risk by employing Dollar Value Averaging during the first decade. Anyone have any thoughts on this?

MF,

Given that the US CAPE ratio is historically high, have you considered increasing your international stock allocation (where the CAPE is relatively low) in order to maximize returns? For example, the 10 year real expected returns for U.S. equities is 1-3% annualized due to the U.S. CAPE being ~25. Whereas a country like Russia (if you can stomach the high volatility) has a ten year expected return of 14% annualized with a CAPE of 5.

https://www.researchaffiliates.com/AssetAllocation/Pages/Equities.aspx

I wouldn’t recommend taking all your equity exposure out of U.S. stocks, but my investments definitely tilt toward low CAPE countries.

Hi everyone, I just wanted to thank you all for the great comments you’ve been posting and the interesting discussions you’ve been having.

I’ve been traveling and visiting friends over the last couple of days, so I haven’t been able to chime in myself, but it’s been great reading everything!

I’m going to be on the road for the next couple of weeks but I plan to dive in to some of the links that have been posted and will join in on the conversation when I get back.

Thanks again and speak to you soon!

Great post MF.

So how does the picture change if you want to run out of money right at your death?

The above math shows that you have some factor F (0.9 – 2.8) of your beginning principal depending on the sequence of real returns but suppose I wanted to have zero money left upon death. Say your 40 and then pick a death age of 100… if you rerun the math how much does this impact the SWR or sensitivity of the first decade?

I’m curious how much more this reinforce the safety of a 4% SWR because remember the goal is not to have as preserve your initial capital until you die – the goal is to *not* run of money before you die.

I think this is a great question. I myself don’t intend to die broke, but I don’t want or need to have several million sitting in the bank when I do die.

After years of trying to figure out exactly where my partner and I are supposed to be for easing off our income requirements but not being able to find anyone talking about how to accurately assess both stepping down gradually from working and not attempting to protect my initial capital, I finally made a fairly large spreadsheet detailing out the next 70 or so years. My spreadsheet, even though rudimentary, gives me the confidence that we are going to be able to be working a lot less, a lot earlier, because I’m willing to start using my capital at the appropriate time.

I’d really like to see MF talk about a retirement plan that assumes that at 100 years old, you only need to have a few 100,000 in the bank.

I had the same question. So i’m very curious indeed.

Why is the whole theory in FIRE based on dying with a bulk load of money.

Me and my girlfriend are also trying to figure out what we need with zero on age 100.

We now have a house without mortgage and that will be what our children will get.

Our portfolio can be 0 if we die.

Hope MF can help with this. Or maybe knows some articles already written on this topic.

I am 72 and had to retire at 65 to care 24 hours a day for my disabled husband. I have never

spent over the SS amount. He passed 3 years ago and I still live on SS. I gift to the children

every year. I don’t even use my pension, RMD or savings.

I think because we never were in debt except for our home and paid that off in the 80’s and put our children through college we made right decisions. We purchased new car, house, and furniture when I retired and moved closer to doctors, hospitals, and shopping. I live in Michigan and with our 2100 sq. foot home plus a walkout basement and 3 car garage our natural gas bills on the budget plan is $48 a month. Being out of debt, having an energy efficient home and car enables

me (a widow) to live on $18,149.86 last year plus gifts. This year with the school tax going up $500 and other things I have purchased I will be closer to $20,000 this year. This is with property taxes of $4800 and Medicare and the supplement, eye, dental and prescriptions of 4400 I still live very comfortably.

^Boss

Your comment, to me, was the most valuable. Someone who has lived a frugal and fulfilling life and still found money to give to others. Very encouraging.

Are the colors on your Safe Withdrawal Rate graph backwards? You have:

3.5 to 4.0% = RED

5.0 to 5.5% = GREEN

Thanks for the nice article.

RED as in a more restrictive and painful annual spending

GREEN as in money money money

Yes… I’m also confused by what the meter is indicating, red/green-wise. Is it pointing at the “ideal” withdrawal rate for current conditions, while the red and green is how happy could be about it?

That’s how I understood it.

One solution is to just work a bit longer. In my case, it took me 15 years to amass 25x but due to the later years of my career being the highest earning and investmens snowballing it only took an additional 3 years to reach 37x.

Andrew, that is kinda what I was suggesting in one of my comments earlier. Reach FI based on the 4% SWR and then work a few years (less hours if you choose) to build up a cushion. I am all for ER but I don’t want to be stressed after ER.

It’s not an unreasonable course of action. You already have momentum on your side to just continue working at your current job and you’re probably at your highest salary so if you’re worried about 25x not being safe enough then just work for an extra 1-3 years and really secure your freedom.

Once you have 25x saved up though you have the confidence to call the shots at work. In my particular case I decided I was going to work from home fulltime, my employer could take it or leave it. They took it. But after three years of that I’m done for good.

For me, I preferred the idea of working a few extra years over potentially having to go back to work after being out of the workforce for an extended period of time.

I want to focus some attention to the impact of fees. Teachers and others saving/investing in the 403b arena should always consider their fees and trading costs. These costs will impact the ability to follow the Safe Withdrawal Rate. I believe teachers could lose 50-60-even 70% of their nest egg because they are investing at high fees, for example in annuities. The cost of most/many annuities sold to teachers is about 2.15%. This cripples a nest egg.

Ted, are you trying to put a hit on your own life. Stop rocking the boat brother, financial advisors©™ and brokers gotta eat too, don’t ya know? Plus, it’s their birthright to skim teacher accounts until the end of time. Jeehs, some people!

Ed, I like what you do for your readers. Press On!

I tell everyone who will listen; unfortunately most don’t listen and when they do, it’s too late:

I always suggest using these free fee calculators:

http://www.401Kfee.com/how-much-are-high-fees-costing-you

and

http://www.petersbeckhamreports.com

and

http://www.analyzenow.com

and

http://www.Buyupside.com/calculaators/feessdec07.htm

I don’t think we should blindly accept the 4% Safe Withdrawal Rate rule and invest only according to that. I really think that would be naive and here is why I think that : 8 reasons why the Safe Withdrawal Rate is not that safe after all http://whatlifecouldbe.eu/2015/10/24/8-reasons-why-the-safe-withdrawal-rate-is-not-that-safe/

I hope it makes sense and we all start a proper discussion about it rather than blindly accept a theory based on past trends. Don’t get me wrong. It’s a good strategy…but should be ONE of your several investment pillars rather than the only one.

MadFI, I’d like to hear your thoughts (and others here) on the variability of safe withdrawal rates when international returns are included. It looks like Kitces is still based on US returns only. If I recall correctly, when you start to look at a mixed US / international portfolio, the 4% rule might not be as bullet proof as we’d like to think based on only US data.

I’m not worried myself too much due to the factors you listed: being able to be flexible, and being able to work again.

However, from a numbers and modelling point of view, ignoring international returns bothers me. The “US is special” assumption bothers could have just been an accident of a particular time in history and geography. Would love to hear more thoughts on just the international aspect and it’s affect on withdrawal rates.

Mad FI,

“The robustness of the 4% rule is one of the main reasons I find dividend-chasing weirdos who don’t want to ever sell any shares so perplexing – not only will they have to work a lot longer to build up a portfolio that can sustain their spending on dividends alone, they are giving up higher overall returns to obtain a level of security that is simply unnecessary.”

I find that comment perplexing. It’s as if the 4% SWR and achieving a 4% overall yield on a dividend growth portfolio are mutually exclusive endeavors. I’m pretty close to attaining a 4% yield on my portfolio and I didn’t even try (I own low-yield stocks like V that make it more challenging). If I wanted to, I could easily attain a yield of 4.5% or 5% and work a lot LESS than those aiming for the 4% SWR. To say one would have to work longer by being a dividend-chasing weirdo is so silly it’s not even funny. Not only will I be collecting roughly 4%, I won’t be selling off assets to do so. And my income will likely grow much faster than inflation. AND I’ll be looking at minimal/no fees for the rest of my life, which will come in handy since I’ll eventually be sitting on a couple million in assets.

By the way, Phau (one of the gentleman behind the original Trinity Study, which is where the 4% SWR originally came from) recently took another look at things with the way the yields of the S&P 500 and bonds are so much lower than they’ve historically been, and he concluded a ~2% SWR is probably more accurate with today’s conditions:

http://www.fa-mag.com/userfiles/stories/whitepapers/2015/WealthVest_Sept_2015_Whitepaper/12040-Pfau-Sustainable-Withdrawal-Rates-Whitepaper-.pdf

Back to being a weirdo… or whatever.

Take care.

Nice paper but this little snippet can not go unnoticed

“To operationalize these combined

advisory and fund fees with the simulated annual

market returns, we apply a total fee of 1.67% to

stocks and a total fee of 1.6% to bonds at the end of

each year before rebalancing.

So with my vanguard funds at .1% I’m back at 3.6% SWR?

2lazy – that’s a GREAT CATCH that no one else has brought up…if you are in index funds (i.e. Vanguard Total Stock Market and a Long Term Bond Fund) how do you argue adding 1.6 – 1.7% to the SWR bringing you back to 3.6%?!?!?

Hi Jason-

Do you have a spreadsheet that details all of your investments? I’d be curious to work out the math and see how your portfolio has grown versus the market. It all comes down to math in the end, right?

I fully acknowledge that an experiment like this should be done over the course of a decades, but I’d still love to crunch the numbers.

In any case, please point me to where I can see a detailed list of all of your investments.

Thanks!

Hi,

excellent article.

I live in Europe where income/capital gains taxes are significant. I guess in the US you still need to declare capital gains when you withdraw and when you receive dividends right?

How would one need to adapt the 4% rule to accommodate for tax?

Thanks,

Luis.

Europe can be a broad brush as tax rates vary depending on which country you reside – UK for example has quite generous treatment for LTG’s and dividends – a couple living off investments there could have over 80K stg before incurring any taxes – no a bad option if you have a EU passport ;)

As for how you treat any tax due , it would be best added to the expense column and continue with your SWR of choice knowing that withdrawal will also need to cover taxes.

Luis, i have the same question. I live in Germany, and we have a 25% tax on capital gains. Although the first 1600€ per year per couple (or 800€ per single) are tax free. I am not very good at maths, so can anybody help how the 4% rule can be adjusted?

@madfientist you’re math skills are asked here!